All Categories

Featured

Table of Contents

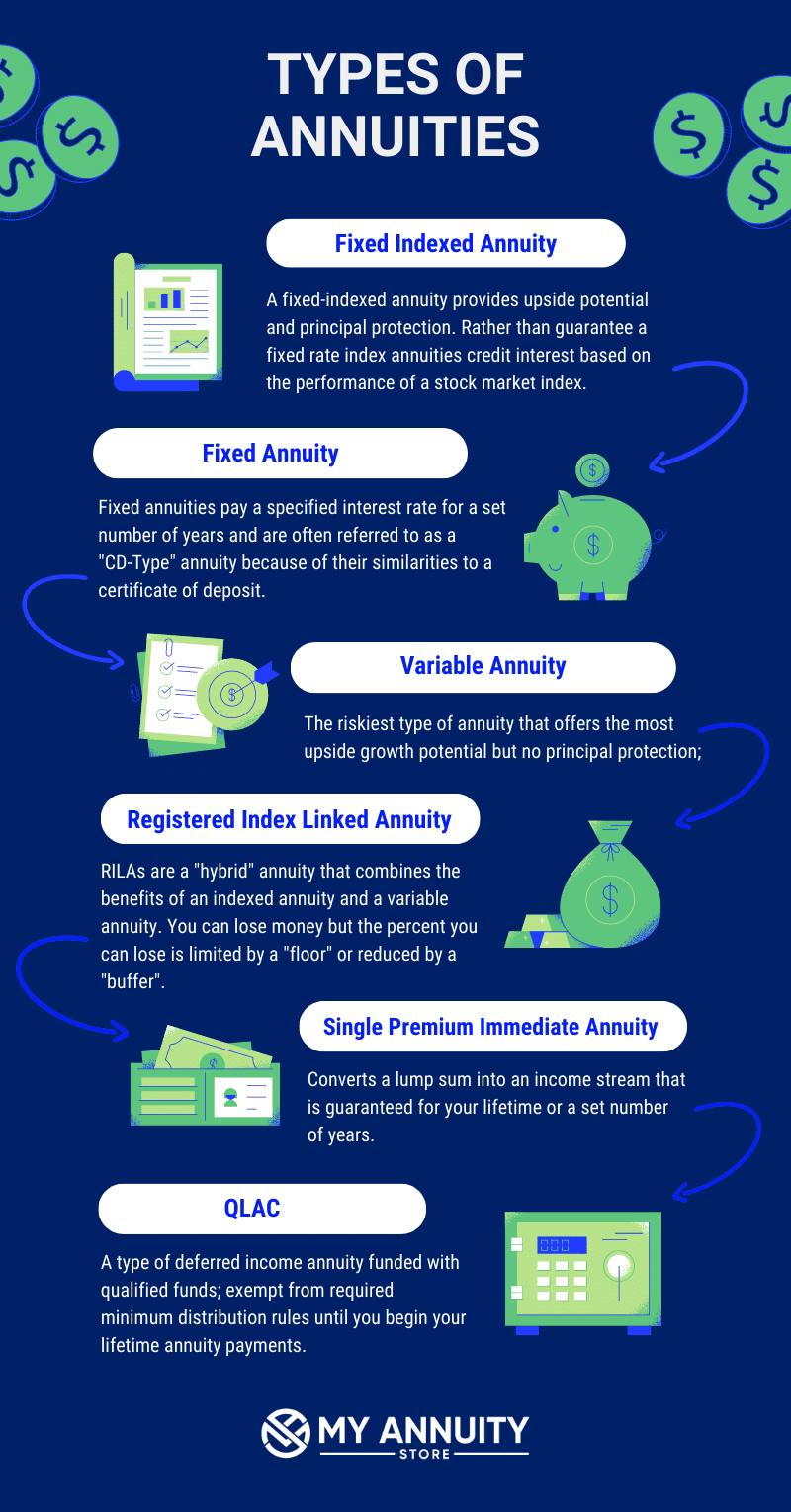

dealt with index annuities: Set index inhabit a middle-ground between fixed and variable annuities, supplying a mix of danger security and market-based development possibility. Unlike a dealt with annuity that offers a guaranteed rates of interest, a fixed indexed annuity is tied to a wide market index. Your returns are based upon the efficiency of this index, subject to a cap and a flooring.

This can supply an appealing balance for those seeking modest development without the higher risk account of a variable annuity. Immediate annuities: Unlike dealt with annuities that start with an accumulation stage, prompt annuities start income payments practically instantly after the initial financial investment (or within a year at a lot of). Called a prompt revenue annuity, it is frequently selected by senior citizens who have already constructed up their retirement financial savings are seeking a trusted way to create routine revenue like an income or pension payment that starts right away.

If you assume a fixed annuity could be the right option for you, below are some things to think of. Annuities can supply normal, foreseeable income for a set variety of years or the rest of your life. However, typically talking, the longer you desire repayments to last, the reduced the quantity of each repayment.

Death benefits: It's essential to consider what will take place to the cash in your dealt with annuity if you pass away while there's still an equilibrium in your account. A survivor benefit feature enables you to assign a beneficiary that will certainly get a specified quantity upon your death, either as a lump sum or in the kind of ongoing payments.

Qualified annuities are moneyed with pre-tax dollars, normally via retirement like a 401(k) or IRA. Premium contributions aren't thought about taxable revenue for the year they are paid, yet when you take earnings in the circulation phase, the entire amount is usually based on taxes. Nonqualified annuities are moneyed with after-tax bucks, so taxes have actually already been paid on the contributions.

The Guardian Fixed Target Annuity SM offers an ensured rate of return for three-to-ten year periods (all may not be offered at all times). You can pick the moment duration that best fits your retirement timespan. We can attach you with a regional financial expert who can describe your alternatives for all types of annuities, evaluate the offered tax obligation advantages, and help you determine what makes feeling for you.

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Benefits of Fixed Annuity Or Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at Annuity Fixed Vs Variable

Numerous people thoroughly compute the amount of cash they'll need to live comfortably in retirement and spend their working years saving for that objective, some still are afraid not having enough. Due to increasing life expectancies, 60% of Americans are conc erned they may outlive their properties. This concern casts an even bigger shadow on participants currently in or near retirement.

An annuity is an agreement between you and an insurer that you can buy by paying a round figure or monthly premium. After the build-up duration, the issuer provides a stream of payments for the remainder of your life or your chosen period. Annuities can be a dynamic automobile to include in your retirement earnings mix, particularly if you're concerned regarding running out of cash.

Breaking Down Your Investment Choices Key Insights on Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Fixed Vs Variable Annuity Advantages and Disadvantages of Choosing Between Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Indexed Annuity Vs Fixed Annuity: Explained in Detail Key Differences Between Fixed Income Annuity Vs Variable Growth Annuity Understanding the Risks of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Variable Vs Fixed Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

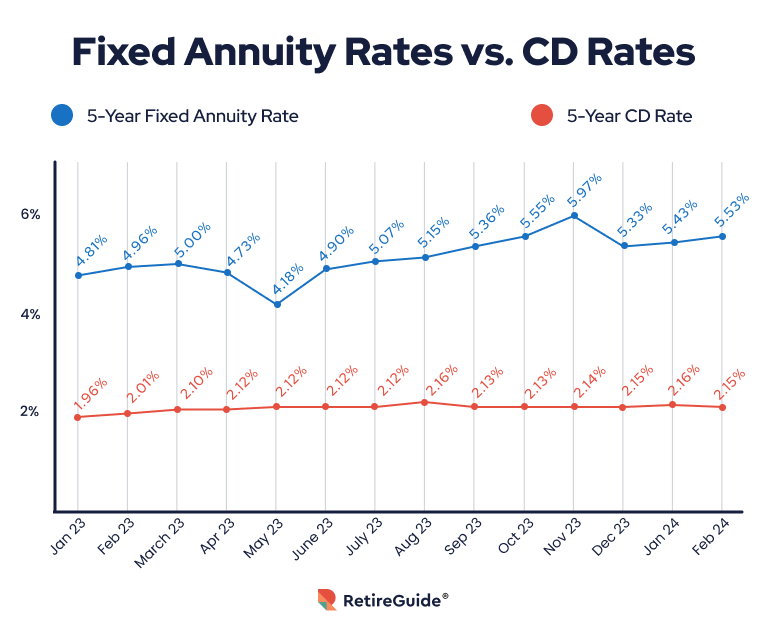

A set annuity is the most straightforward kind, offering a trustworthy and predictable revenue stream. The insurance provider assures a set rates of interest on your premium, which creates a stable earnings stream over the remainder of your life or a specific period. Like deposit slips, these annuities are frequently the best remedy for more risk-averse capitalists and are amongst the safest investment choices for retired life portfolios.

Your primary investment continues to be undamaged and can be handed down to enjoyed ones after fatality. Rising cost of living is a normal component of financial cycles. Typical fixed annuities may lack defense from rising cost of living. Set annuities have a stated rates of interest you make despite the market's performance, which may indicate losing out on possible gains.

While you can take part in the market's upside without risking your principal, repaired index annuities restrict your return. While you can purchase other annuities with a stream of settlements or a swelling amount, immediate annuities need a swelling amount.

As with most annuities, you can determine whether to obtain repayments for a particular duration or the remainder of your life. Immediate annuities give a steady stream of income you can't outlive.

Here are seven concerns to ask to help you discover the right annuity. Immediate annuities have a short or no accumulation period, while deferred repayment annuities can last over 10 years.

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices Defining Annuity Fixed Vs Variable Advantages and Disadvantages of Different Retirement Plans Why Fixed Annuity Vs Variable Annuity Is a Smart Choice Indexed Annuity Vs Fixed Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Income Annuity Vs Variable Annuity? Tips for Choosing Fixed Vs Variable Annuity FAQs About Variable Vs Fixed Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Indexed Annuity Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Different annuities have various fees. Recognize the expenses connected with your chosen annuity. Inspect with economic score firms like Standard & Poors, AM Best, Moody's, and Fitch.

Annuities can be intricate and complex, even for experienced investors. That's why Bankers Life offers customized assistance and education and learning throughout the procedure. We focus on comprehending your requirements and leading you towards options to assist you attain your perfect retirement. Fascinated in having a skilled economic professional testimonial your scenario and deal customized understandings? Contact a Bankers Life representative today.

Each individual needs to look for details suggestions from their own tax or legal experts. To identify which financial investment(s) may be ideal for you, please consult your economic expert previous to spending.

Both IRAs and postponed annuities are tax-advantaged means to intend for retired life. They function in really various ways. As pointed out above, an IRA is a savings account that provides tax obligation advantages. It is like a basket in which you can place various kinds of investments. Annuities, on the various other hand, are insurance items that transform some savings right into assured payments.

A specific retired life account (IRA) is a kind of retired life savings lorry that permits investments you make to grow in a tax-advantaged way. They are a wonderful method to save lengthy term for retirement.

Exploring Fixed Index Annuity Vs Variable Annuity A Comprehensive Guide to Immediate Fixed Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Matters for Retirement Planning Fixed Income Annuity Vs Variable Growth Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Retirement Income Fixed Vs Variable Annuity FAQs About Tax Benefits Of Fixed Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Fixed Vs Variable Annuity Pros Cons A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity

Commonly, these financial investments are supplies, bonds, mutual funds, or even annuities. Each year, you can spend a specific amount within your IRA account ($6,500 in 2023 and subject to change in the future), and that investment will grow tax cost-free.

When you withdraw funds in retired life, though, it's strained as ordinary earnings. With a Roth IRA, the cash you place in has already been exhausted, yet it grows tax complimentary over the years. Those profits can after that be withdrawn free of tax if you are 59 or older and it has been at the very least 5 years since you first added to the Roth IRA.

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuities Features of Fixed Annuity Vs Variable Annuity Why What Is A Variable Annuity Vs A Fixed Annuity Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Choosing Between Fixed Annuity And Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

No. Individual retirement accounts are retirement financial savings accounts. Annuities are insurance products. They operate in entirely different ways. You can in some cases put annuities in an individual retirement account though, or utilize tax-qualified individual retirement account funds to buy an annuity. So there might be some crossover, however it's the type of crossover that makes the fundamental differences clear.

Annuities have actually been around for a long time, however they have become much more common recently as people are living longer, less individuals are covered by traditional pension plan strategies, and intending for retirement has actually become more crucial. They can typically be integrated with other insurance policy items like life insurance coverage to create full security for you and your family.

Table of Contents

Latest Posts

Mony Annuities

Lic Annuity Scheme

New York Life Income Annuity

More

Latest Posts

Mony Annuities

Lic Annuity Scheme

New York Life Income Annuity